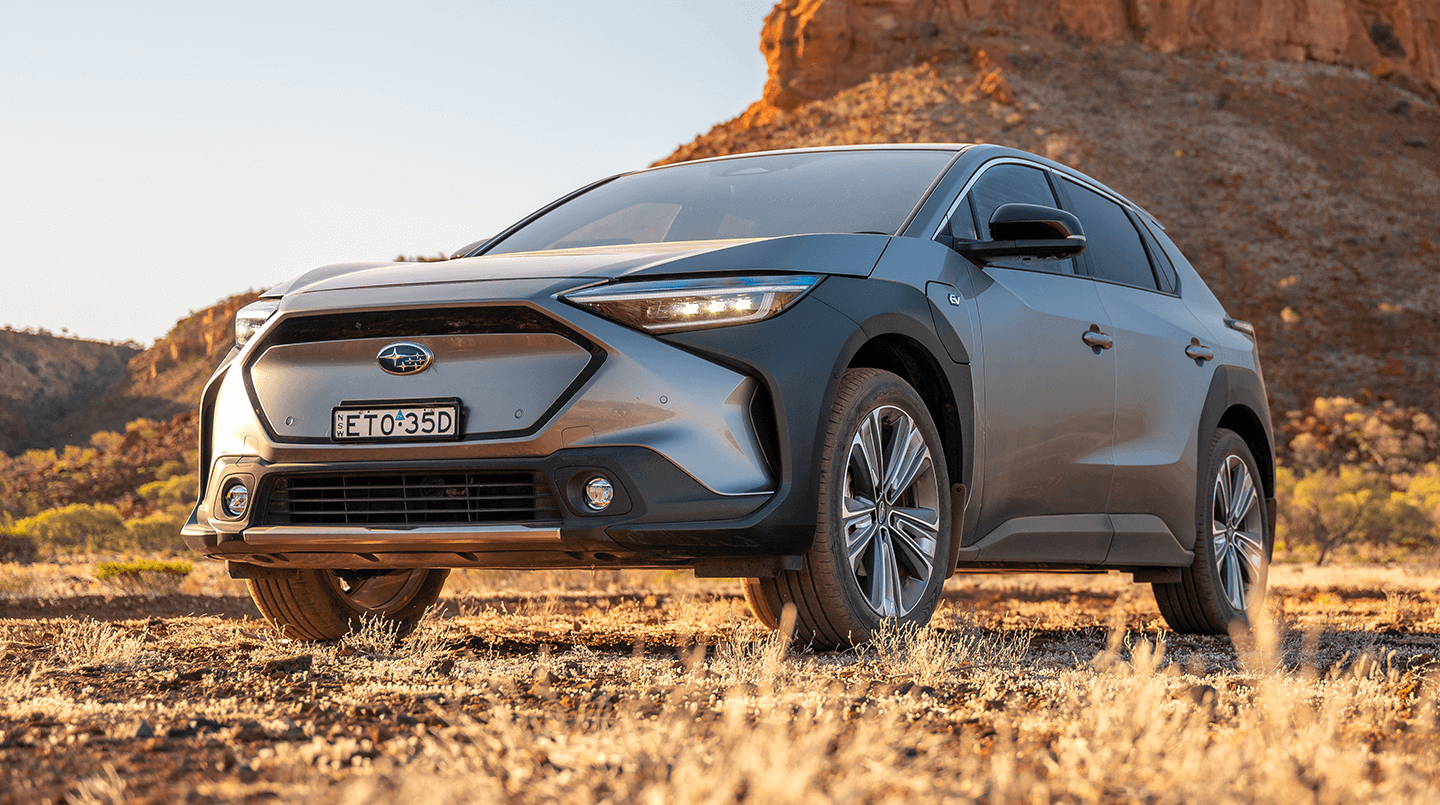

The instant asset write-off (IAWO) scheme, a popular tax incentive for businesses purchasing vehicles and equipment, is facing calls to be made permanent. This move could provide much-needed certainty for ute buyers and other business owners who have been grappling with frequent changes to the scheme.

The Coalition has circulated amendments in the Senate to make the instant asset write-off permanent. Industry groups, including CPA Australia, the Australian Chamber of Commerce and Industry, and the Tax Institute, have welcomed the push for a permanent scheme.The current temporary nature of the scheme, with yearly extensions and changes, has created uncertainty for businesses planning investments.

For the 2024-25 income year, the government has proposed a $20,000 threshold for eligible assets, down from previous higher limits.Businesses with an aggregated annual turnover of less than $10 million can access the scheme under the current proposal.

Some industry groups are advocating for a higher threshold of $30,000 and an expanded eligibility to businesses with up to $50 million turnover.

The scheme's frequent changes have made it difficult for businesses to take advantage of the incentive, with some measures becoming law just days before expiring. Ute buyers, in particular, face challenges as most new utes exceed the proposed $20,000 threshold, potentially forcing them to look at the used market.

The push for a permanent scheme comes as a response to the ongoing uncertainty faced by businesses, particularly those in industries relying on work vehicles like utes. A permanent IAWO could provide the stability needed for long-term investment planning and potentially stimulate economic growth in the small business sector.