Millions of Australians could be entitled to refunds of up to $144,000 through junk insurance compensation schemes, but the clock is ticking.

The Australian Financial Complaints Authority (AFCA) has extended the deadline to lodge a complaint about junk insurance to 30 June 2025, giving thousands more Australians the chance to claim what they're owed.

What is Junk Insurance?

Junk insurance refers to add-on policies like consumer credit insurance, mortgage protection insurance, or loan protection, often sold alongside credit cards, loans, and mortgages. These policies were frequently presented as mandatory, when in fact they were optional and often provided little or no value to the consumer.

In many cases, the cost of the insurance was rolled into the loan, significantly increasing interest and the total amount to be repaid.

Who's Eligible?

If you took out a credit card or loan before July 2019, there's a chance you were unknowingly sold junk insurance. Eligible Australians may have been charged for policies with little value or coverage they didn’t need or understand.

You may see it on statements as:

- Consumer Credit Insurance (CCI)

- Credit Card Insurance

- Mortgage Protection Insurance

- Loan Protection

Victims of junk insurance can claim refunds through their financial institution or via companies like Claimo, which assist in processing claims (note: they typically charge a 30% fee on any refund).

Life-Changing Refunds

Australians across the country have already seen significant payouts:

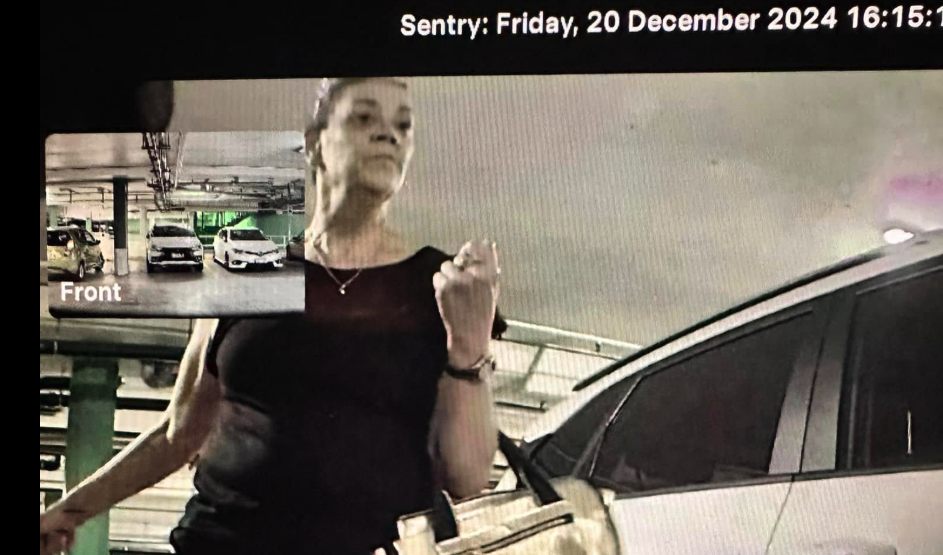

- Donna, a pensioner, received $11,000, describing the money as life-changing.

- Karen from Victoria got $15,000 after discovering junk insurance attached to three personal loans.

- Teena and Troy from NSW received a massive $111,159, which they’ll use to pay off their home.

- Tracey, a mother of two, was refunded $90,000 after discovering insurance she was convinced she needed when opening a credit card.

The highest recorded payout to date stands at $144,000.

How to Check and Claim

- Review old loan documents and bank statements.

- Look for any premiums or line items labelled as:

- Credit Card Insurance

- Consumer Credit Insurance (CCI)

- Loan or Mortgage Protection

- Contact your financial institution or lender directly.

- Alternatively, use services like Claimo to investigate and lodge a claim on your behalf.

Why the Deadline Matters

AFCA has been managing the refund process, working with banks and insurers who were ordered to set aside $10 billion after the 2019 Banking Royal Commission.

The June 30, 2025 deadline is final, and AFCA warns consumers not to delay.

"It’s important that consumers know this deadline is fast approaching," AFCA’s Lead Ombudsman Emma Curtis said. "Now is the time to act."

Still Billions Unclaimed

Despite the enormous payouts already made, experts believe billions of dollars remain unclaimed. A survey of over 4,400 Australians revealed that 60% weren't sure if they had ever been sold junk insurance.

Whether you took out a car loan, personal loan, mortgage, or credit card in the past two decades, it’s worth checking your eligibility.

Visit the ASIC website or AFCA for more information.