The $200 Demerit: How a Single Point Can Spike Your CTP Premium

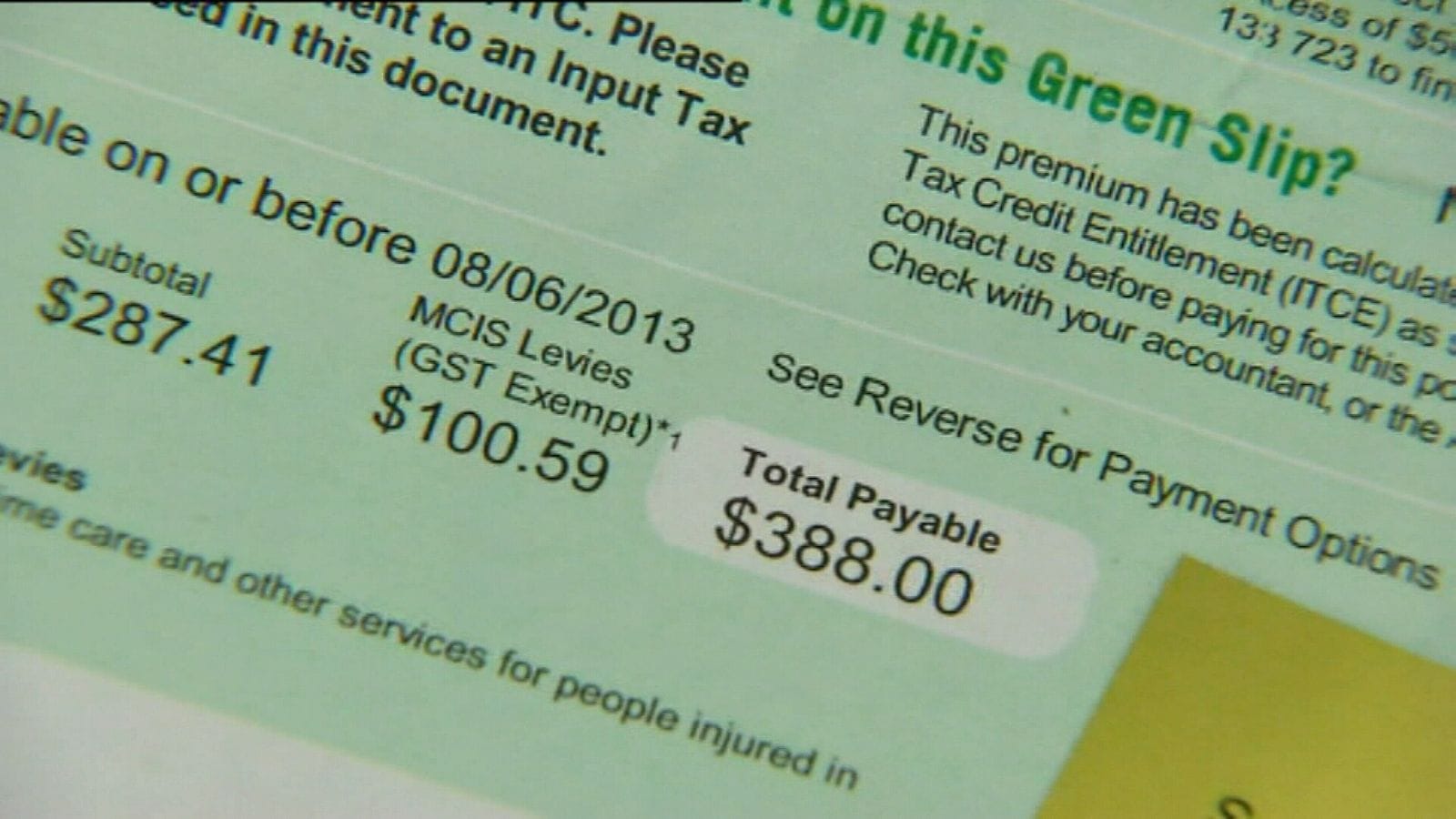

In 2024, NSW drivers face a new reality when it comes to Compulsory Third Party (CTP) Green Slip insurance. Recent changes to the Compulsory Third Party (CTP) Green Slip insurance scheme in New South Wales have introduced a new pricing structure that directly impacts drivers with demerit points.

Even a single demerit point on your driving record can now hit your wallet hard, potentially adding a staggering $200 to your annual CTP Green Slip renewal in NSW.

Understanding the New CTP Pricing Structure

The State Insurance Regulatory Authority (SIRA), which oversees the NSW CTP scheme, has implemented these changes to create a more risk-based pricing model. The new structure aims to encourage safer driving practices by financially penalizing those with driving infractions.

Key Points of the New System:

- Drivers with one or more demerit points will face higher CTP premiums.

- The additional fee is applied annually at the time of CTP Green Slip renewal.

- The exact increase in premium varies based on the number of demerit points accrued.

Impact on NSW Drivers

This change affects a significant portion of NSW motorists. Even minor infractions that result in a single demerit point, such as low-level speeding offenses, can now lead to increased insurance costs.

Examples of Offenses Resulting in Demerit Points:

- Speeding less than 10 km/h over the limit: 1 point

- Not stopping at a red light: 3 points

- Using a mobile phone while driving: 5 points

The Rationale Behind the Changes

The NSW government and SIRA argue that this new pricing structure serves multiple purposes:

- Encouraging Safer Driving: By directly linking driving behavior to insurance costs, the system incentivizes safer road practices.

- Fair Distribution of Costs: Higher-risk drivers now contribute more to the insurance pool, potentially leading to lower premiums for safer drivers.

- Reducing Road Accidents: The financial deterrent may lead to fewer traffic violations and, consequently, fewer accidents.

NSW Closes CTP Loophole

A significant loophole in the NSW Compulsory Third Party (CTP) insurance system has recently been closed. Previously, some drivers attempted to avoid higher premiums resulting from their poor driving record by nominating another person as the vehicle owner when purchasing CTP insurance.

This practice, often referred to as the "bad behaviour tax" loophole, allowed drivers with demerit points or traffic infringements to potentially secure lower insurance rates. In a move to enhance the integrity of the CTP system, insurers are now cross-checking vehicle ownership details with Service NSW.

This new verification process ensures that the true owner of the vehicle is accurately identified, preventing individuals from exploiting the system. As a result, drivers can no longer evade the financial consequences of their driving history by misrepresenting vehicle ownership. This change is expected to create a fairer CTP pricing structure and encourage safer driving practices across NSW.

How to Minimize the Impact

For NSW drivers looking to keep their CTP Green Slip costs down, the message is clear: maintain a clean driving record. Here are some tips:

- Obey all traffic rules and speed limits

- Avoid distractions while driving, especially mobile phone use

- Regularly check your demerit point status

- Consider taking a safe driving course to improve skills and awareness

Looking Forward

As this new system takes effect, it's crucial for NSW drivers to be aware of how their driving behavior can impact their insurance costs. While the change may be challenging for some, it aligns with broader efforts to improve road safety across the state. Drivers are encouraged to check with their CTP provider or use the Green Slip price comparison tool on the SIRA website to understand how these changes might affect their individual premiums. Remember, safe driving not only saves lives but now also saves money on your CTP Green Slip insurance.