January 2025 Sales Breakdown

Tesla delivered just 739 vehicles in January 2025, marking a 33.2% decline compared to January 2024. The results were driven by a stark contrast between its two models:

| Model | Jan 2025 Deliveries | YoY Change |

|---|---|---|

| Model Y | 465 | +21.1% |

| Model 3 | 274 | -62.1% |

This represents Tesla’s worst monthly performance since July 2023, when logistical issues limited deliveries to just four vehicles.

Model 3’s Unexpected Decline

The Model 3’s sharp downturn is particularly surprising given its 2024 refresh, which included updated styling, improved range, and enhanced tech. Despite these upgrades:

- Model 3 deliveries fell 62.1% year-over-year in January 2025.

- The sedan’s slump follows a 75.3% collapse in January 2024 due to a temporary stop-sale.

Industry analysts speculate the BYD Seal, which delivered 589 units in January 2024, may be eroding the Model 3’s market share.

Model Y’s Cautious Optimism

Australia’s best-selling EV, the Model Y SUV, posted a 21.1% year-over-year increase in January 2025. However, challenges persist:

- 2024 saw Model Y deliveries drop 26.1% overall.

- An updated Model Y is expected in May 2025, potentially revitalizing demand.

2024 Performance Context

Tesla’s Australian struggles are part of a broader trend:

- Total 2024 deliveries fell below 40,000 units, with sales declining in nine months.

- Aggressive discounting and the refreshed Model 3 failed to reverse the slide.

Competitive Pressures

- BYD Seal: Emerged as a strong Model 3 rival, with 412 units sold in December 2024.

- Polestar’s Decline: The Swedish brand reported an 45.3% drop in January 2025 deliveries (82 units), driven by an 87.3% collapse in Polestar 2 sales.

Market Challenges

Reporting Practices: Tesla and Polestar do not report sales to the Federal Chamber of Automotive Industries (FCAI), complicating market analysis.

Consumer Sentiment: Rising interest rates and economic uncertainty may be dampening EV adoption.

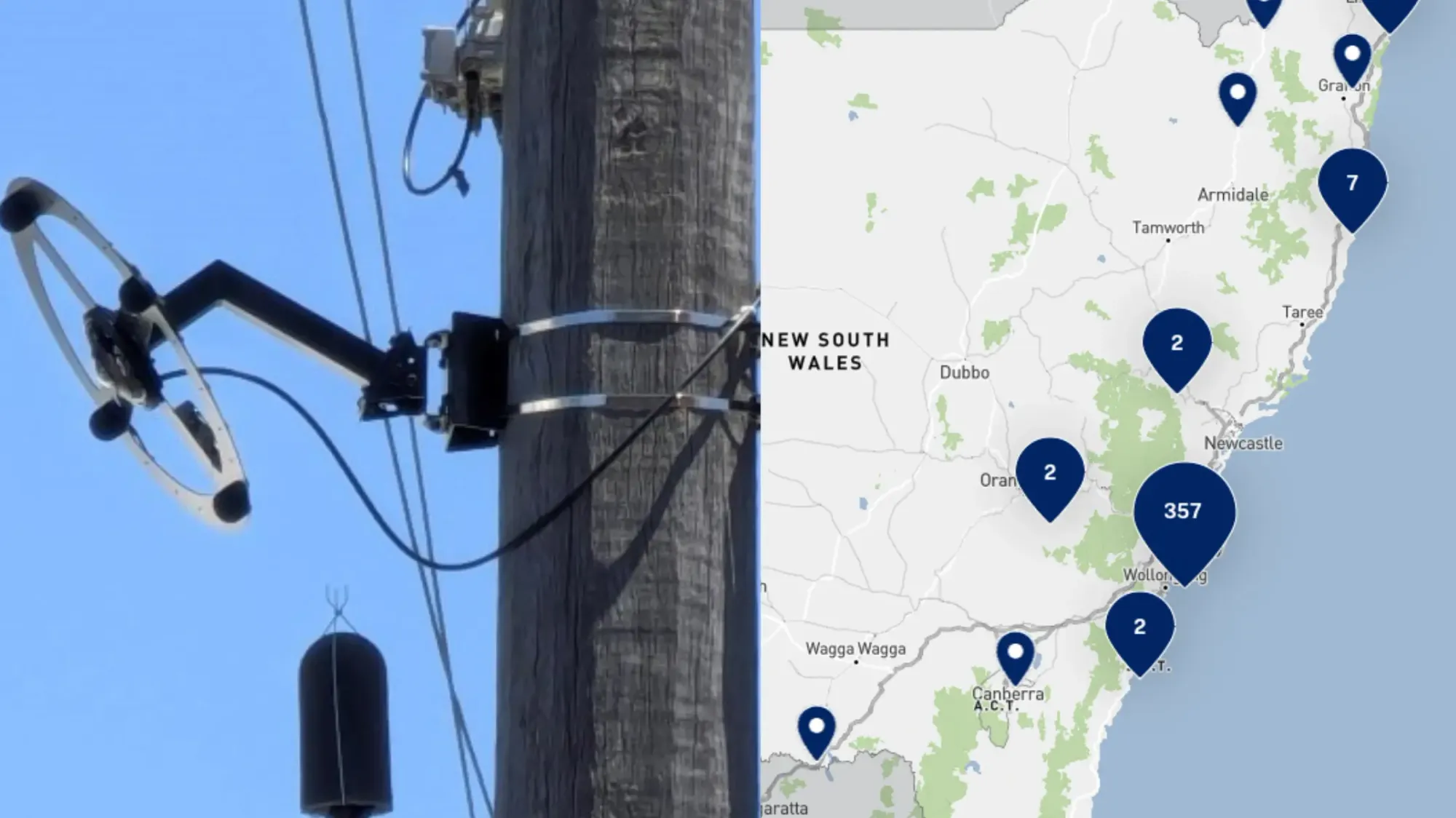

Infrastructure Gaps: Australia’s charging network growth lags behind EV sales ambitions.

Tesla’s Australian performance reflects mounting pressures in the EV sector. While the Model Y’s growth offers hope, the Model 3’s decline suggests heightened competition and potential buyer fatigue with Tesla’s aging lineup.

The upcoming Model Y refresh and rumored affordable Model 2 could reignite interest, but Tesla must address pricing strategies and charging infrastructure concerns to maintain dominance.

With BYD and other Chinese automakers gaining traction, 2025 may prove pivotal for Tesla’s long-term position in Australia. The brand’s ability to adapt to local market dynamics—while balancing global production priorities—will determine whether this slump becomes a trend or a temporary setback.